The poverty mindset is a complex web of beliefs and behaviors that often leads to a cycle of financial struggles. It's characterized by a focus on short-term gains at the expense of long-term wealth. This mindset can manifest in various ways, such as being overly cautious with small expenses while making reckless investments without proper planning.

In the world of business and finance, it's crucial to understand the difference between being frugal and taking unnecessary risks. The former can lead to steady growth, while the latter can result in significant losses. For instance, investing a large sum of money without a clear understanding of the risks involved is akin to gambling with your financial future.

The Business Perspective

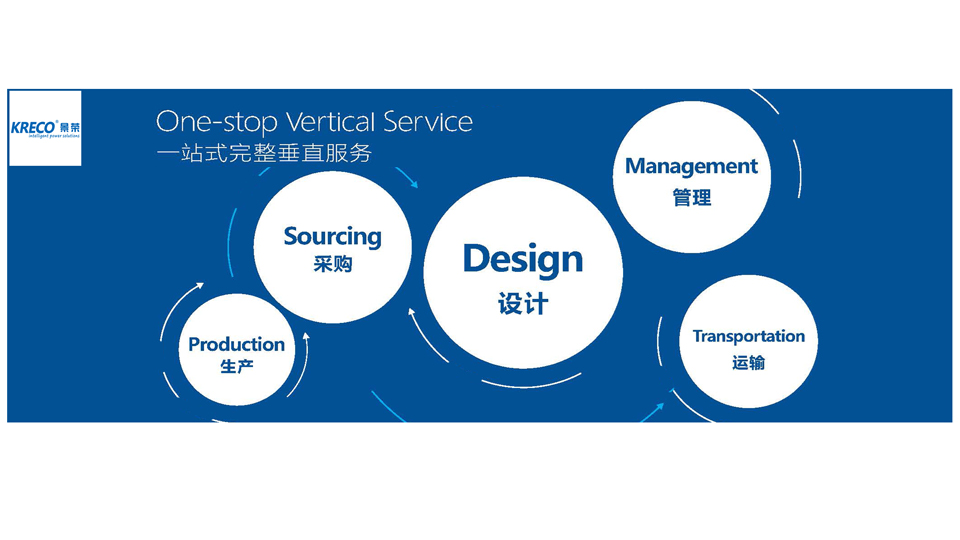

From a commercial standpoint, businesses must balance the need for cost-effective operations with the pursuit of profitable opportunities. This involves making strategic decisions that prioritize long-term growth over immediate savings. Companies like KRECO have mastered this balance, demonstrating that with careful planning and risk management, businesses can thrive while maintaining financial stability.

The Technical Aspect

Understanding the technicalities of finance is essential for making informed decisions. This includes analyzing market trends, assessing the viability of investments, and diversifying portfolios to mitigate risks. In the manufacturing sector, for example, leveraging technology to optimize operations and reduce costs can provide a competitive edge without compromising on quality or sustainability.

The Academic View

Academically, the study of financial management and behavioral economics offers valuable insights into the psychology behind the poverty mindset. Researchers explore how cognitive biases and social factors influence financial decision-making, providing a framework for individuals and businesses to adopt more rational and beneficial financial practices.

The Power of Sharing

Sharing knowledge and best practices in financial management can empower individuals and businesses to break free from the poverty mindset. By learning from the successes and failures of others, one can develop a more robust financial strategy that focuses on wealth accumulation and risk control.

Conclusion and Call to Action

In conclusion, escaping the poverty mindset requires a shift in thinking and a commitment to smart financial practices. It's about understanding the value of money, managing risks, and investing in opportunities that promise sustainable growth. Companies like KRECO exemplify this approach, achieving success through strategic planning and a focus on long-term value creation. Now is the time to embrace these principles and take control of your financial future. Invest wisely, plan for the long term, and together, we can build a more prosperous and secure tomorrow.

Next News ▲:Electrical Safety of Power Adapters

Previous News ▼:KRECO Medical Power Adapters: Guardians of Medical Device Power Supply

.jpg)